Your fast debt recovery solutions

The powerful CRM with updates features to boost collection!

All types of lenders rely heavily on the collection. Each lending institution establishes its own collection rules and infrastructure. As a result of this ecosystem, every kind of defaulted customer can be properly classified. Different strategies for recouping the money are employed for different types of payment defaulters. This process relies on a number of interdependent systems working in together. This collection ecosystem consists of both office-based and field-based teams.

Companies in this position could benefit from a customer relationship management system for debt collection that:

-

Integrates with their loan management system (LMS) to retrieve data,

-

A platform that classifies the data (based on the rules set up by the organizations),

-

A platform that is integrated with telephony to facilitate easier calls,

-

A system that can talk to their payment database whenever a customer makes a payment.

They also require a system that communicates with teams out in the field. All of this necessitates a strong platform that makes the difficult world of collection a little easier to crack (though it is never easy).

CREYSTO CRM for debt recovery includes all of these features and more. As you go through the features, you’ll see why it’s ideal for NBFCs and other lending platforms today.

CREYSTO's CRM makes debt collection easy.

CREYSTO automates communication and boosts collections.

Distribute borrowers to regions, teams and agents

CREYSTO automatically assigns borrowers to regions, teams, and agents. Several factors highlight the significance of this. To begin with, it guarantees that all borrowers are paired with the most competent agent. Secondly, it makes sure each borrower is placed in the optimal region to qualify for the best mortgage rates and terms. Lastly, it guarantees that everyone on the team has sufficient work to do by fairly dividing the borrowers among them.

Categorise borrowers & define collection strategies

CREYSTO understands that each borrower category has a different risk profile and repayment capacity. One-size-fits-all collections won’t work for all borrowers. You can put borrowers into one of three groups based on their ability to pay back the loan and how risky they are. Borrowers in Bucket 1 are most likely to repay on time and pose little credit risk. Those borrowers who fall into “Bucket 3” are the highest credit risk because of their high probability of loan default. Moreover, we have established distinct procedures for collecting from each type of borrower.

Plan the collection agents’ day completely

CREYSTO is aware that a well-organized day leads to more productive agents and, in turn, higher revenue collection. Seniors can plan everything about the schedules of the collection agents because they know that agents work best when their days are organized. As a result, there is no guesswork or time wasted because they know what to do and when to do it. CREYSTO collection CRM for debt recovery ensures that agents stay on task and make the most of their time by planning their days. That will result in increased revenue for your company.

Automate communication to debtors based on their actions

CREYSTO allows you to set up automated reminder emails, text messages, and even WhatsApp messages. Keeping creditors informed of their payment status is a key function. It’s now easier than ever for your staff to monitor debtor payments. CREYSTO allows you to keep track of your debts from the time they are identified and entered into the collections queue until they are resolved (or written off).

Ensure your teams are well-connected for smooth operations

Debt collection via CREYSTO with a streamlined interface and a clear channel of communication,this CRM guarantees that your teams are always in sync. Team members are able to effectively coordinate their efforts by exchanging information and working together. There is no way for another agent to see who is working on a particular case once it has been assigned. It will prevent unnecessary follow-up calls to the same customer.

Manage end-to-end field collections lifecycle

Managing time-consuming administrative tasks has never been easier than with Cresyto’s brand-new, mobile-friendly platform. It’s simple for your field agent to send in receipts and other paperwork. Additionally, thanks to automation and immediate notifications, you’ll be fully informed about every debt, allowing you to concentrate on collecting the money you’re owed.

Features of CREYSTO Sales CRM

With CRESYSTO Collection CRM, you can quickly, easily, and courteously collect payments.

Data Management

- Upload Excel or CSV files and update the records through customized rules which will ensure that your data is always clean

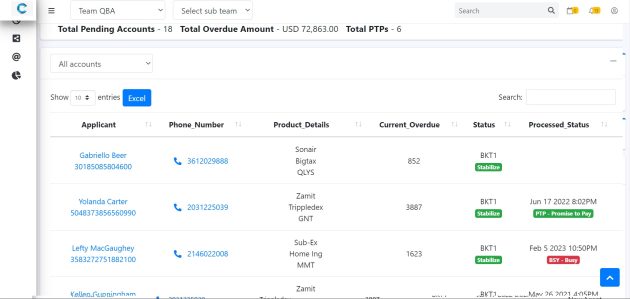

- The data can be segregated based on predefined rules which govern each segment/bucket (Bucket 1, Bucket 2, Bucket 3, etc.)

- You also have an error page where you can see the records that didn’t, unfortunately, conform to the upload rules

- Once the data is uploaded, you can choose from various options to allocate the records to your team which can be manual or automated to avoid human errors and save time

- While allocating, you can have multiple permutations & combinations to ensure effective utilization of data

- You can change the allocation logic from time to time and along the way

API Integrations

- Integrate with the LMS to push the customer information to and from the CRM

- This helps in following up with customers daily/weekly/ monthly collection information with regards to the due date and other information updates

- Payment API to push any payment information when the payment is made in real-time

Manage Records

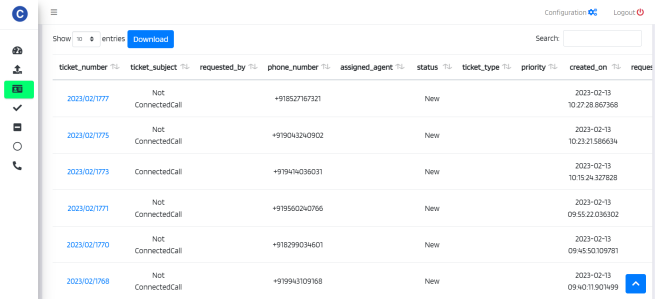

- The contact page is a custom design to help the Collections team to have various segregated views to see the records in a specific manner –

- Filters based on Buckets, Status, Disposition, Assignment, processed and unprocessed Status of overall records further segregated by unprocessed, processed, overdue and PTPs

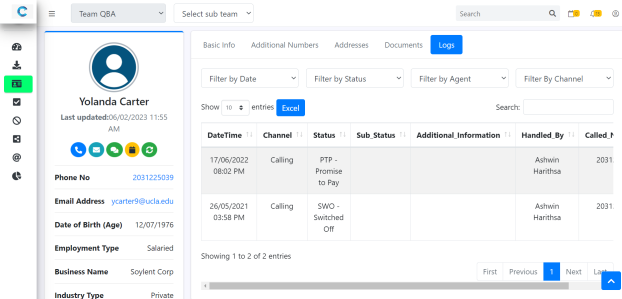

- Each record then has all the customer details that exists in the file

- Alignment of fields –using the experience of our UI designer and working in conjunction with the customer, the fields are placed and spaced conforming to the design standards and ease of use

- Records are integrated with email, SMS, and cloud telephony. There is a security tab to track the users who have accessed the record and the changes that they have made

- The records can be collaborated with field agents who can access via mobile

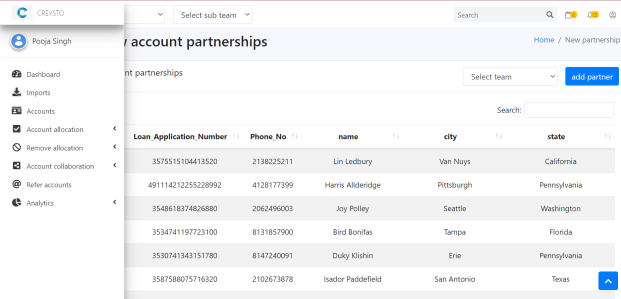

Account Management

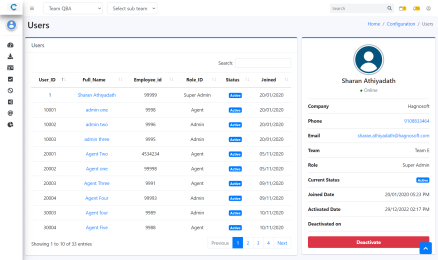

- Create various teams like the user, admin, senior admin, etc..under the multiple departments according to the organization structure and can have multiple levels of role-based access

- There can be further segregation of users based on in-house and external agencies tie-ups to further control access

- All the interactions of each customer are recorded

- You can change your dashboards, add new items and remove with ease

- Create your customised reports with various parameters you would like to track and choose the visualization graph that best describes the information

Communication Suite

- Telephony Integration – Call or schedule the call to the customer with ease from the application itself

- Email Integration – send emails to your co-workers, vendors, partners, and customers with a various template created to avoid human errors

- SMS & WhatsApp Integration – Whether you need standard SMS responses, payment links, or any other important promotion information regarding your products; do it all with a click of a button

Performance & Analytics

- Create your own customized reports. There are some custom reports that are exhibited, they can be further customized based on your need.

- Track what is important to you and the management through customized data visualization on your dashboard

- You have the ability to change your dashboards, add new items and remove the ones that are not so important to you with ease

- Option to download various parameters from every single page in the application

Security

- Dual factor authentication has been introduced, wherein the user has to login using their official email ID and their registered mobile number through randomly generated OTP

- Data encryption is done for sensitive data like customer phone, email

- SSL certificate to ensure no breach in the data traffic over the internet

Our Clients

Continuous Improvement

One of the things in the evolution story from the time we went LIVE with our first customer a couple of years ago was the endeavour for constant upgrade, never be happy with what has been delivered (even though it checks all the requirements of the customer); always work towards a better UI and UX. Once you start the engagement, you will never ever truly get rid of us. We will always be around. You can reach us whenever you need something or have a suggestion to make things better. We are all ears. We will also monitor your team to see what they do and how we can make their life better.

Create a long term, sustainable, cost effective solution to drive your business to higher sales and better productivity. Use CREYSTO today, ask for a demo NOW

Benefits of CREYSTO Debt Collection CRM

- Supports complex team structures with role based access making it simpler for teams within and outside the organisations to have defined access

- Integrations with the customer systems makes it easier to have all the data in one place

- Send templated and specific updates to customers via email, sms or whatsapp to customer based on the status

- Live updates when payments are made

- Reminders and automations which makes the life of the callers easier

- Reports and Dashboard to call out various kinds of performance metrics to give you a firm control of the situation